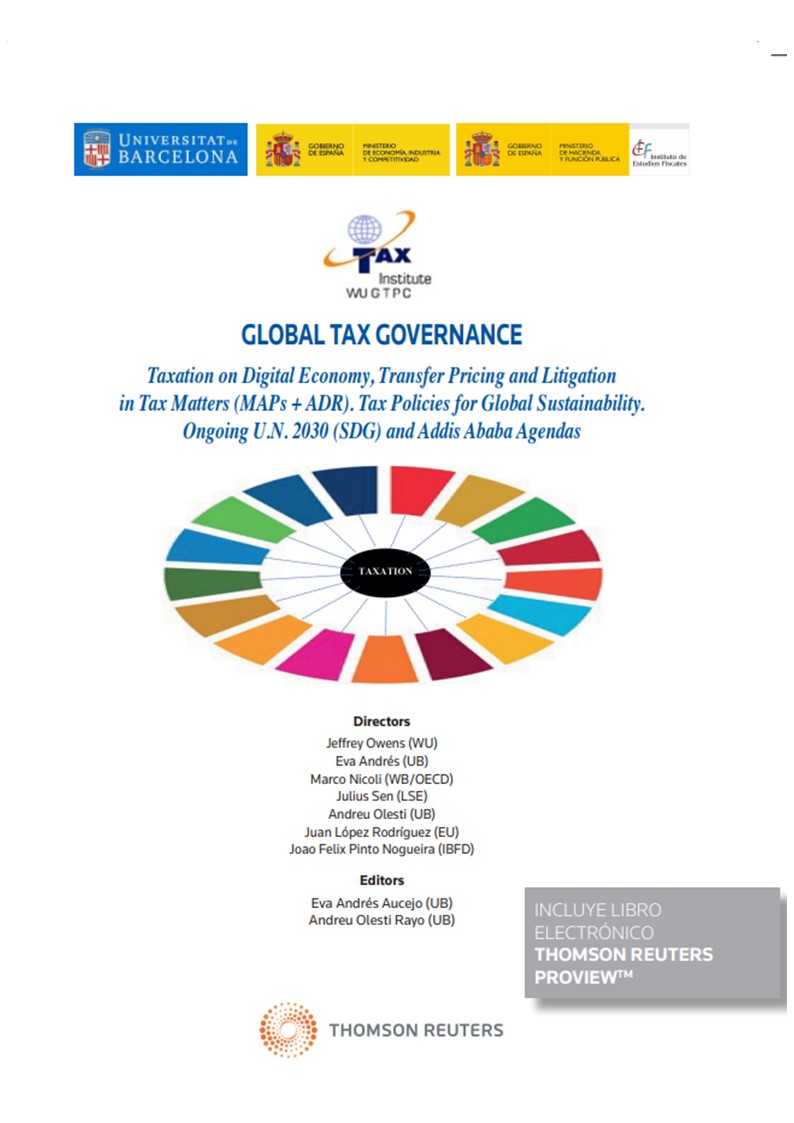

The new century highlights the relevance of the international tax cooperation policies within a global tax governance environment. In line with the recent launching of the Platform for Collaboration on Tax promoted by the United Nations, the International Monetary Fund, the Organisation for Economic Cooperation and Development and the World Bank, this book deals with fundamental issues related with the role of international institutions towards the fostering of a global tax cooperation environment. This book addresses the principles, sources and costs of the international tax cooperation and global tax governance agenda, as well as the role played by taxpayers rights in the interaction with modernized and digitized tax administrations from a comparative perspective. There is no doubt that International Tax Cooperation and Global Tax Governance have achieved a pivotal role in the new global Economy and Legal Order and this book is meant to address in a comprehensive way these very topical developments.

-5%

Global Tax Governance. Taxation on digital economy, transfer pricing and litigation in tax matters (maps + ADR) policies for global sustainability. Ongoing U.N. 2030 (SDG) and Addis Ababa Agendas

ISBN: 9788413462493

El precio original era: 42,11€.42,11€El precio actual es: 42,11€. 40,01€ IVA incluido

Hay existencias

| Peso | 630 g |

|---|---|

| Fecha de Edición | 12/11/2021 |

| Plazo de entrega |

24 h |

| Número de Edición |

1 |

| Idioma |

Inglés |

| Formato |

Libro + e-Book |

| Páginas |

400 |

| Lugar de edición |

NAVARRA |

| Encuadernación |

Rústica |

| Colección |

MONOGRAFÍAS ARANZADI |

| Editorial |

ARANZADI THOMSON REUTERS |

| EAN |

978-84-1346-249-3 |